- Auburn School District

- Your Pay & Taxes

Payroll, Benefits & Retirement

Page Navigation

-

Your Pay & Taxes

Last Updated Thursday, May 15, 2025

-

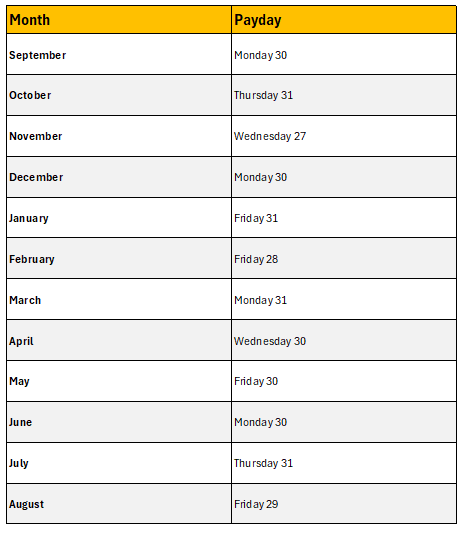

Paydays

Last updated Thursday, February 27, 2025

Payday occurs on the last business day of each month.

Your base salary is paid in the current month's payday. Approved extra hours will be paid in the following month.

For accurate and timely payment, your worked hours and time off must be entered, submitted, and approved by your Time & Absence Approver before the Timesheet Approval Deadline. If the time submitted is approved after the deadline, the pay for extra hours will be processed on the next payday.

-

Viewing Wage Statements (paystubs)

Employees should regularly review their wage statements for accuracy. There also may be a need to print current or past statements. You can do this yourself through your employee access.

Click on the link below for a quick tutorial on accessing your wage statement.

-

Direct Deposit

Direct Deposit is required for all Auburn School District employees. Click on the link below to log in with your work credentials to update or add your primary account and/or up to three additional accounts for direct deposit.

If you have not completed your direct deposit request before the 10th of the month, you may receive a physical check. This will be held at the District office, and you can pick up your check on or after payday.

If you have questions, please contact your payroll strand.

-

Tax Withholding Information

W4

Submit a new W-4 Form by logging into Google with your work email and clicking the link below.

Things to keep in mind

- The W-4 form is used to inform your employer of how much federal income tax to withhold from your paycheck.

- Accurately completing the W-4 helps avoid incorrect payments of taxes, which can affect tax returns at the end of the year.

- A W-4 form must be completed when starting a new job, or if personal or financial circumstances change.

- District staff may complete a new W-4 at any time.

- Changes to W-4 information for existing employees will take effect on the next monthly paycheck.

- Always review your next wage statement to verify that your changes are correct. Allow up to 3 weeks for processing.

Payroll staff are not tax professionals and cannot provide tax advice. If you need assistance completing the W-4 form, we recommend that you use the IRS resources provided below or consult with a qualified financial advisor or your tax professional.

Helpful IRS Resources

- IRS Tax Withholding Estimator: Use this tool to determine how much tax you should have withheld: IRS Tax Withholding Estimator.

- W-4 Form and Instructions: Refer to the IRS’s guide for detailed instructions on how to complete the form: Form W-4 and Instructions.

- Publication 505: Tax Withholding and Estimated Tax: Provides additional information on tax withholding and estimated taxes: Publication 505.